What Is A Neobank?

Why should online banking be more complicated than online shopping or choosing which series to stream? That’s what neobanks like Snappi believe. We are changing the face of banking, making it faster, simpler, and more accessible. But what is a neobank?

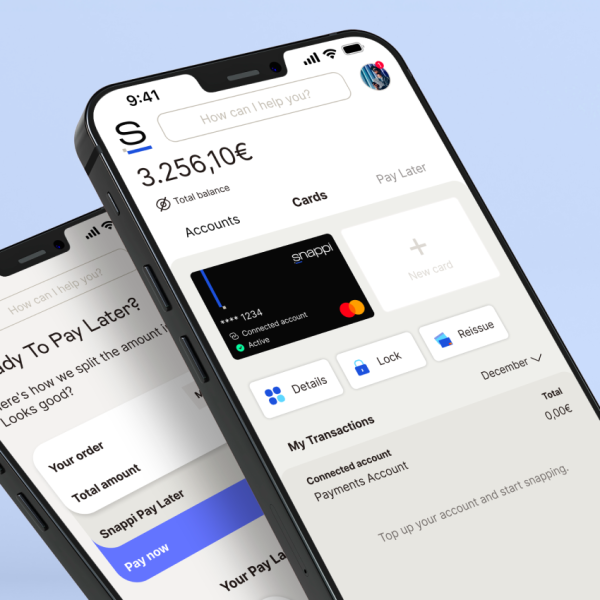

Neobanks offer all the services of traditional banks. The only difference is that neobanks are digital-only, with no physical branches. Neobanks cut out the inconvenience and wasted time, and bring banking straight to your smartphone. That makes transfers, payments and account management much easier for users.

Traditional Bank

- In-branch meetings

- Up to 10 days wait on transfers

- Charges for transfers

- Complicated paperwork

- Banking jargon

Neobank

- 24/7 Support (In-app chat & call center)

- Instant transfers

- Free transfers

- Easy transactions

- Simple communication

Still wondering how neobanks differ from the mobile banking services of traditional banks? Here’s a more detailed breakdown.

👉Tech-first

Neobanks leverage the latest technologies and constantly innovate. As a neobank, our mission is to make banking an effortless part of daily life experiences. Regular banks, however, tend to be rooted in tradition. Although they are working to build an online presence, their legacy interfaces are almost impossible to change and modernize.

👉 Lower fees

The absence of overheads to maintain physical branches, reduces the financial burden of neobanks. Therefore, they can charge lower account maintenance, withdrawal fees and cross-border transactions.

👉 Faster services

Designed with a digital mindset, neobanks use innovative workflows to expedite processes. This makes account set-up, transaction authentication and customer support quick and easy. It takes just minutes to open an account and get verified. Traditional banks need you to visit their nearest branch, fill in application forms and submit paperwork. And of course, you must do it during opening hours.

👉 Customer-centric

From user-friendly applications, and intuitive interfaces, to personalized dashboards and tailored services, neobanks are listening to what you want. Traditional banks have a long way to go in prioritizing customer experiences.

👉 Innovation-driven

Neobanks understand their customers. They constantly work to future-proof their apps with valuable features. In fact, they want to empower you with knowledge and the tools to take charge of your own financial journey. For this reason, they offer you budgeting tools, personalized savings plans, analytics, payment/overspending alerts and financial education.

👉 Responsible and inclusive

Neobanks are paperless, branchless operations committed to sustainable practices and green finance. Neobanking is designed to make banking services accessible to unbanked and underserved customers. For instance, utilizing credit with a traditional bank requires a credit card or loan which is not always easy to obtain. A neobank, on the other hand, is able to use advanced data acquiring models with AI to conduct background checks to expedite the process. Traditional banks cannot easily eliminate their paper-based processes and require customers’ credit history in order to issue credit. Neobanks are more agile and able to help you build a credit history.

👉 Secure

Cloud-based neobanks employ industry best practices and superior security frameworks to keep your money and data protected. Some examples are state-of-the-art identity verification and transaction encryption. While transaction authentication in traditional banks is robust, it often involves in-person visits or calls leading to delays and stress.

Neobanks offer a full range of money management services

- Account management

- Processing of payments

- Cash transfers

- Virtual & Physical cards

- Micro-investment

- Wealth management

- Peer-to-peer transfers

- Insurance

- E-wallet services

How do neobanks work?

Neobanks work by leveraging financial technologies and innovation. With the power of data analytics, they are better equipped to assess your financial activity and preferences to offer personalized services. They also analyze spending behaviors to make lending and credit decisions for small businesses and individuals. Neobanks form strategic partnerships with third parties to embed their financial services. This makes money management seamless across your spending and saving experiences.

Neobanking with peace of mind

Snappi is the first Greek neobank to get a banking license from the European Central Bank. We understand that trust is the basis of every good relationship. That’s why getting a license was a top priority. This means you can travel anywhere in Europe and use your money just like you would in Greece.

Below are the security and compliance features we apply in order to strengthen security:

- PSD2-compliance

- Tokenization ready

- EMV chip technology

- Multi-factor authentication

- PCI-DSS transaction security

- Encryption-secured digital wallets

- GDPR and DORA compliance

Snappi brings you convenience, transparency and joyful interactions. Discover more about the neobank that offers banking the way you want it.