Why Snappi focuses on financial literacy

Why Snappi focuses on financial literacy

Having come through the 2008 financial crisis and the post-pandemic economic upheaval, it’s only natural that getting money-smart should be high on your ‘to do’ list. At whatever stage you are in life – be that starting out with your first job, launching a startup, or saving for a big purchase, then financial literacy will help you learn how to better manage your money.

But first, what is financial literacy?

Financial literacy is all about building the right skills to manage your money. Think savings, investments, taxes, and more. It helps you make informed financial decisions to manage your debt and plan for that vacation. Gaining financial skills helps you build savings for emergencies and a comfortable retirement without needing to compromise on today’s pleasures. Financial education not only teaches you how to manage money but also how to make it work for you.

Money wisdom is the new flex

Strong financial skills help you:

- Build financial habits early and reap their lifelong benefits

- Make informed credit decisions and pay back loans comfortably

- Cruise through the uncertainties of life and the economy

- Diversify investments to balance risk and security

- Budget for the present while securing your future

Where to get financial education?

There’s a lot of financial advice out there — but not all of it is reliable. At Snappi, you’ll find simple, trustworthy content on our blog and social media to help you feel more confident about your money.

Here are a few ways to build your financial skills:

💡Take the traditional route

Hitting the books is a great way to level up your financial knowledge. We do know squeezing in the time and having the patience can be difficult. That’s why we make it simple for you. At Snappi, we are on a mission to empower people to manage their own money through financial literacy. That’s why we offer quick and easy-to-understand resources to strengthen your financial know-how.

💡 Discuss with your FinLit friends

It’s time to open up the discussion about finances. What was once considered a private or taboo topic is now openly discussed amongst friends and chat groups both which can offer great opportunities to grow your financial skills. These can be great places to grow your financial skills. Just be sure to do your own homework and be critical with what you hear or read.

💡 Listen to a podcast or summary

Audios are a great way to enrich your financial knowledge at any time. Listen to a podcast while commuting.

💡 Learn by doing

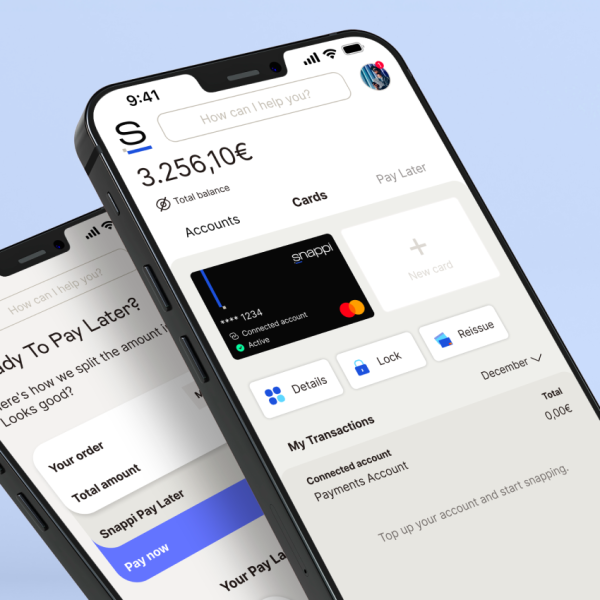

Money management apps help you plan for and be aware of your expenses. Some of them have money analytics to offer deeper insights. Set financial goals and crush them to gain rewards while building spending hygiene.

💡 Get help

There’s no harm in asking your personal network of friends and family how they built their savings. Yes, times have changed, but you can always learn from them, their mistakes and lessons. If that doesn’t fit the bill, seek professional help or take a course.

We want to remind you to always verify the credibility of your sources. This applies especially to so-called ‘free’ financial advisers.

A well-rounded financial curriculum includes:

Money management – saving, spending, budgeting, etc.

Financial planning – importance and ways of building long and short-term strategies

Concepts of investment – time horizon, risk tolerance, compounding, financial markets

Credit products – EMIs, foreclosure, BNPL, building creditworthiness, mortgages, loans

Insurance – types and needs, calculating cover and payments, and choosing the best fit

Sharpen your financial skills NOW

Financial literacy is more than paying your bills without compromising on desires, or paying off a major loan. It’s about taking charge of your money flow and making it work for you. Getting the right financial education helps you plan for the future without compromising on your present needs or future financial goals. At Snappi, we actively work to make banking a joyful and effortless experience with innovative offerings and resources for financial literacy.